Homeowners Just Tapped $25 Billion in Equity in Q1

Check Out This Weeks Newsletter

Homeowners Just Tapped $25 Billion in Equity in Q1

In Q1 2025, U.S. homeowners pulled nearly $25 billion in home equity through second-lien mortgages, marking the strongest first-quarter volume since 2008.

According to the latest June 2025 Mortgage Monitor from ICE Mortgage Technology, this 22% year-over-year surge signals a major shift in borrower behavior, driven by easing interest rates, record-high equity levels, and rising consumer interest in HELOCs.

This signals that homeowners are ready to re-engage, especially those looking to finance renovations, consolidate debt, or fund major purchases without giving up a low first-lien mortgage.

Here’s what’s happening and what it means for your real estate business.

Tappable Equity Just Hit a Record $11.5 Trillion

Home equity has ballooned over the past decade, but many borrowers have been reluctant to touch it. That’s starting to change.

U.S. mortgage holders carried a record $17.6 trillion in home equity entering Q2 2025. Of that, $11.5 trillion is considered tappable, meaning it can be borrowed against while preserving at least 20% equity.

- 48 million mortgage holders have tappable equity, with an average of $212,000 per borrower.

- The average mortgaged home is only 45% leveraged, giving homeowners a significant cushion to tap into.

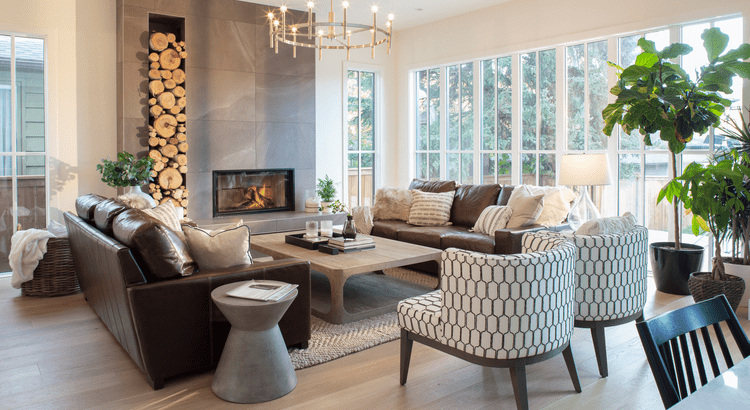

These numbers point to massive opportunity, especially for homeowners who want to stay put and renovate rather than trade up.

Why Borrowing Is Getting More Affordable

The rise in second-lien activity isn’t just about high equity. It’s about improved affordability, too. HELOC rates have dropped substantially since early 2024, making borrowing more attractive for homeowners who don’t want to refinance into a higher first-lien rate.

- HELOC rates have dropped by 2.5 percentage points in recent quarters.

- Rates fell below 7.5% in March, and could reach the mid-6% range by 2026 if the Fed follows through with expected rate cuts.

- On a $50,000 HELOC, monthly payments dropped from $412 to $311, saving homeowners over $100 per month.

Lenders are also getting more aggressive with rate offerings. The spread to prime is now at its lowest level since 2022, adding more competitive pressure and opening up even better terms for borrowers.

This is something worth passing on to the homeowners in your database, especially those who’ve indicated an interest in making changes to their home.

Equity Withdrawals Are Rising, But There’s Still Room to Grow

While the surge in HELOC activity is notable, homeowners are still withdrawing only a fraction of their available equity. In total, $45 billion was withdrawn via HELOCs and cash-out refinances in Q1 2025. That’s the highest first-quarter total since 2022.

Yet only 0.41% of available tappable equity was accessed, which is still below long-term averages.

This means we’re still in the early innings of what could be a larger wave of equity access, particularly if rates continue to ease and homeowners grow more confident in the economy.

Much could depend on what happens with tariffs in the coming months.

Homeowners Are Paying Attention

According to ICE’s latest Borrower Insights Survey, about 25% of homeowners are considering a HELOC or home equity loan in the next year. That’s a significant pool of potential clients, many of whom will need guidance navigating their options.

As Andy Walden, ICE’s head of mortgage and housing market research, put it:

“Equity levels remain historically high, and now we’re seeing the cost of borrowing against that equity drop meaningfully.”

And as ICE President Tim Bowler added:

“It’s periods like these—where both demand and affordability trends converge—that represent a critical opportunity for housing finance professionals to earn homeowners’ repeat business.”

All the more reason for you to share this data and ask homeowners in your area if they have any questions about borrowing against their equity, whatever their reasons for doing so.

Be ready to educate and highlight opportunities for your clients to get the results they want while saving both time and money.

Key Takeaways for Real Estate Agents

- Equity-rich clients are warming up to borrowing. With lower HELOC rates and higher tappable equity, many homeowners may be more open to selling, renovating, or investing.

- Help homeowners explore all their options. A client sitting on $200K in equity might not want to sell, but they could be open to tapping that equity for an ADU, home office, or kitchen remodel.

- Stay connected to lenders. Building relationships with loan officers who specialize in HELOCs can help you add value and earn referrals.

- Educate your database. Most homeowners don’t realize how much equity they have or how affordable it’s become to access it. That’s your opportunity.

Key Details:

- The latest ICE Mortgage Technology report shows U.S. homeowners tapped nearly $25 billion in home equity during Q1 2025—the highest first-quarter volume since 2008 and a 22% increase year over year.

- Home equity reached a record $17.6 trillion, with $11.5 trillion considered tappable.

- HELOC rates have dropped by 2.5 percentage points, lowering monthly payments on a $50,000 line from $412 to $311.

Sarah Lentz | Jun 4, 2025 | Housing Market

https://nowbam.com/homeowners-just-tapped-25-billion-in-equity-in-q1/

@ChuckBarberini - #ChuckBarberiniRealEstate - @ChuckBarberiniRealEstate

@Golden_State_Guide_Service - @Citizen.Number.One

Categories

Recent Posts