Is Housing Part of the Fed’s Plan? Powell’s Latest Press Conference Explained

Check Out This Weeks Newsletter!

Is Housing Part of the Fed’s Plan? Powell’s Latest Press Conference Explained

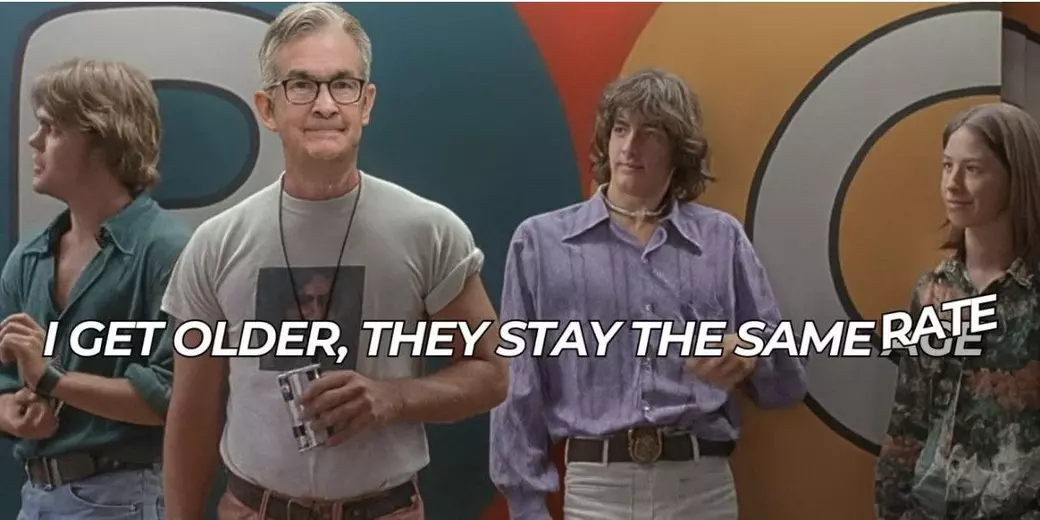

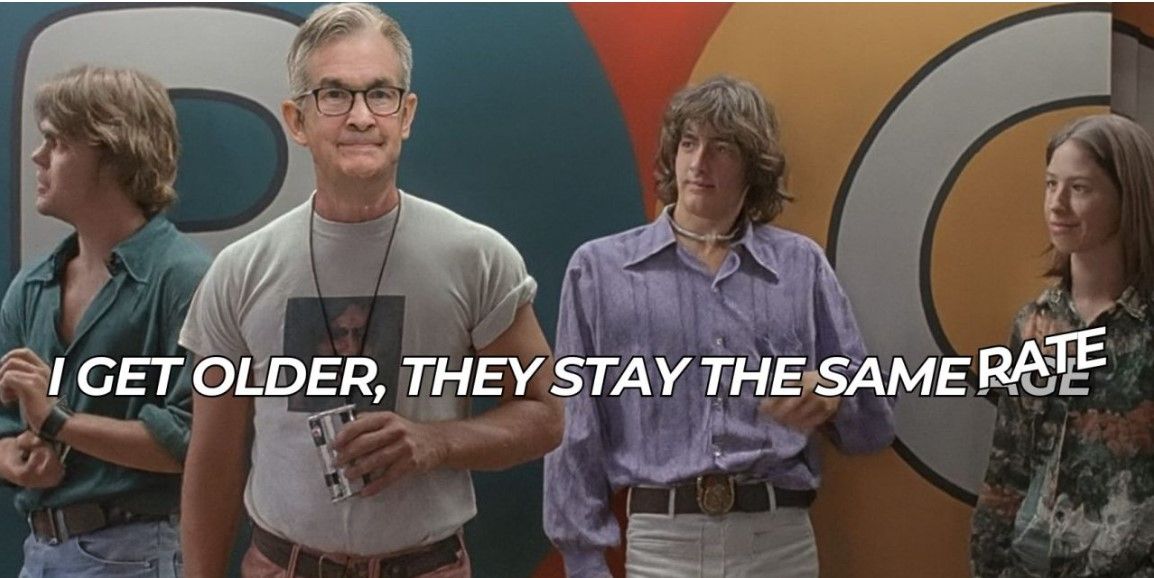

As expected (by most), the Federal Reserve kept the rates steady, though for the first time since 1993, two of the Committee members voted against the chair for a 25-basis-point cut. Housing was mentioned exactly zero times in the press release and only once in Chair Powell’s opening statement.

Two reporters brought it up, though, during the FOMC press conference, with one of them asking Powell how he justified keeping the rates in the range of 4.25% to 4.5% when it meant mortgage rates remained elevated, keeping potential homebuyers stuck on the sidelines.

Put differently, is this hesitation part of some master plan that will somehow benefit homebuyers in the longer run? Or is housing just not part of Powell’s calculus?

The Fed chairman argued, again, that the best thing the Committee can do to “contribute to housing” is to get to 2.0% inflation. And since some tariff-induced inflation is still expected in the coming months, the move right now is…to stay put.

Judging by some of the other reporters’ questions, that line has been played out.

Housing Mentions during the FOMC Press Conference

At the FOMC press conference, Chair Powell made one very brief mention of the housing market in his opening statement. During the presser, two reporters brought it up in relation to the Fed’s 9-to-2 decision to keep rates unchanged.

Others asked the chairman for clarification on the likelihood of a rate cut in September, as well as whether a continued pause could incentivize businesses to raise prices.

We’ll start with Powell’s brief mention of housing in his opening statement (02:42):

“Although the increase in the second quarter was stronger at 3%, focusing on the first half of the year helps smooth through the volatility in the quarterly figures related to the unusual swings in net exports. The moderation in growth largely reflects a slowdown in consumer spending. In contrast, business investment in equipment and intangibles picked up from last year’s pace. Activity in the housing sector remains weak.”

Mentions of Housing by Reporters and Powell’s Responses

Edward Lawrence of FOX Business and Jeff Cox of CNBC.com were the only reporters at the presser who mentioned housing (or any other housing-related term).

Chair Powell’s responses will sound familiar. Read on for transcripts of the most relevant questions and Powell’s responses.

(07:22) – Question from Howard Schneider, Reuters:

“There’s a lot of lean in the markets, and not to mention out of the administration, for a rate cut now in September. Is that expectation unrealistic at this point?”

Powell’s response (07:34):

“So as you know today we decided to leave our policy rate where it’s been, which I would characterize as modestly restrictive. Inflation’s running a bit above 2% as I mentioned, even excluding tariff effects. The labor market’s solid, historically low unemployment, financial conditions are accommodative and the economy is not performing as though restrictive policy were holding it back inappropriately. So, it seems to me and to almost the whole committee that the economy is not performing as though restrictive policy is holding it back inappropriately and modestly restrictive policy seems appropriate.

“All that said, there’s also downside risk to the labor market. In coming months, we’ll receive a good amount of data that will help inform our assessment of the balance of risks and the appropriate setting of the federal funds rate.”

(16:43) – Question from Nick Timiraos, Wall Street Journal:

“Chair Powell, my question is about what have you learned over the last few months about the inflation generating and price pass through process? And just to drill down, the June CPI report showed evidence of tariff induced goods inflation. Now the tariff landscape is only starting to be settled with some of these more recent deals. Given the lags between when tariffs are announced and when they show up in goods prices is two months a long enough horizon to evaluate the impact and be confident that tariffs aren’t impacting the broader inflation process?”

Powell’s response (17:20):

“I think you have to think of this as still quite early days. And so I think what we’re seeing now is substantial amounts of tariff revenue being collected on the order of 30 billion a month, which is substantially higher than before. And the evidence seems to be mostly not paid only to a small extent through exporters lowering their price and companies or retailers, sort of people who are upstream, institutions that are upstream from the consumer are paying most of this for now. It’s starting to show up in consumer prices, as you know in the June report. We expect to see more of that and we know from surveys that companies feel that they have every intention of putting this through to the consumer, but the truth is they may not be able to in many cases.

“So, I think we’re just going to have to watch and learn empirically how much of this and over what period of time. I think we’ve learned that the process will probably be slower than expected at the beginning, But we never expected it to be fast and we think we have a long way to go to really understand exactly how we’ll be. So that’s how we’re thinking of it right now.”

(18:35) Follow-up question by Nick Timiraos:

“So, if I could follow up, is the reticence to look through core goods inflation being driven by the judgment that, during the pandemic, expectations proved more adaptive than anyone at the Fed expected? Has it been driven by uncertainty over how restrictive policy is?”

Powell’s response (18:51):

“You could argue we are a bit looking through goods inflation by not raising rates. We haven’t reacted to new inflation, but I mean I wouldn’t insist upon that, but I think, as I said, a reasonable base case is that these are one time price effects. Of course in the end…this will not turn out to be inflation because we’ll make sure that it’s not. We will, through our tools, make sure that this does not move from being a one-time price increase to serious inflation. We want to do that efficiently, though, efficiently, and that means we want to do it…If you move too soon, you wind up maybe not getting inflation all the way fixed and you have to come back. That’s inefficient. If you move too late, you might do unnecessary damage to the labor market. So, there won’t be, in the end, a big inflationary problem. What we’re trying to do is accomplish that in a way that is efficient, but in the end there should be no doubt that we will do what we need to do to keep inflation under control. Ideally we do it efficiently.”

Note: Nick Timiraos shared the above response in one of his recent Tweets on the FOMC press conference.

(27:52) – Follow-up question from Edward Lawrence, FOX Business:

“And just to follow, if I could, some additional tariffs have been in place since February and things really haven’t broken yet with the economy. So how do you justify to somebody who’s looking for a house who’s facing a 7% mortgage and maybe can’t afford those rates? How do you justify that?”

Powell’s response (28:09):

“Well, so, housing is a special case. We don’t set mortgage rates at the Fed, right? We set an overnight rate and the rates that go into mortgages are longer-term rates like treasury rates. It might be 30 year rates, it might be shorter than that, but it’s not the overnight Fed’s rate. It’s not that we don’t have any effect. We do have an effect, but we’re not the main effect.

“There are other things, though, going on in the housing sector and one of those is just, there’s kind of a long-term housing shortage that we have. We haven’t built enough housing. This is not something the Fed can help with and that’ll be the case even after things normalize.

“So, I think the best thing that we can do for housing is to have 2% inflation and maximum employment and that’s what we can contribute to housing. There are lots of other jobs to do for the private sector and Congress, but that’s what we’re trying to get to. We made a lot of progress toward that. We have a very good labor market right now. Inflation, we were very close to 2%. We’re seeing some goods inflation move us away, but so far not very far away.”

(42:32) – Question from Jeff Cox, CNBC.com:

“A metric that you like to cite a lot is the final sales to private domestic purchasers that was down to 1.2% gain in second quarter from 1.9% in Q1, suggesting that there’s some softening and underlying demand. I’m just wondering if you look at that and you combine that with some of the housing numbers, the weakness that you acknowledged at the top of your remarks that the housing market is in fact weak and the inflation numbers from GDP today came down to 2.1% for headline, 2.5% for core. I’m wondering how much more movement you would need to see from these data points before you would be comfortable with cutting in say September.”

Powell’s response (43:17):

“It’s going to be hard to answer that specifically. PDFP, I think for the first half, probably domestic final purchases or final sales as people call it, was 1.6 on the first half. GDP, I believe was 1.2%. That’s the whole half. You mentioned the quarters. So, those are slower. But GDP is bumpy, quarter to quarter, half to half and often gets revised after the fact. The labor market data we continue to think is the best data we have on the economy and that shows a 4.1% unemployment rate. It shows wages still at a healthy level, but moving ever closer to what we would regard as long run sustainable, consistent with longer run productivity and 2% inflation. So the labor market is actually still quite solid.

“Inflation is above target, even ignoring tariffs, it’s a little bit above target and tariffs. So we’re watching all of that. And again, trying to do the right thing in what is a challenging situation because you’re being pulled in two directions and you have to decide which of those it took to go in. And actually at some point, if they’re sort of equally at risk, then you really want to be at a neutral policy stance, which we’re not right now.”

(44:40) – Follow-up question from Jeff Cox:

“So, it’d be safe to say that if the data kind of stays in line with where it is right now that you wouldn’t be comfortable with cutting in September?”

Powell’s response (44:45):

“I’m not going to say that. No, I just think we’re going to need to see the data and it can go in many different directions, the inflation data and the employment data and we’ll just, we’re going to make a judgment based on all of the data and based on that balance of risks analysis that I mentioned.”

As Byron pointed out during his Hot Sheet breakdown, the Federal Reserve will have two major inflation reports and two major labor reports to consider between now and the September FOMC meeting, not to mention their upcoming Jackson Hole Symposium.

Sarah Lentz | Jul 31, 2025 | Housing Market

https://nowbam.com/is-housing-part-of-the-feds-plan-powells-latest-press-conference-explained/

@ChuckBarberini - #ChuckBarberiniRealEstate - @ChuckBarberiniRealEstate

Categories

Recent Posts